How to protest ICE with your tax dollars

2026 war tax resistance guide

In response to ICE’s murders of Renee Good and Alex Pretti, tens of thousands of people participated in a nationwide general strike on January 30. For the same reasons, my inbox is filled with people asking how they can continue to protest government funding of ICE by withholding their own taxes, a practice called war tax resistance.

2026 is my third year covering war tax resistance.

In 2024, there was heightened interest in war tax resistance because people protested the US government’s continued funding of Israel. In 2025, heightened interest came from Trump’s inauguration. This year, the collective rage and grief we all feel about our taxes funding ICE’s violence is overwhelming. War tax resistance has become an outlet for that rage and grief.

The war tax resistance movement is growing.

Last week, I went live on Instagram with Lincoln Rice, a coordinator at the National War Tax Resistance Coordinating Committee (NWTRCC), who has been a resister himself since 1998. During our conversation, he said, “In a typical January, we might have 4,000 to 5,000 unique visitors to our website. Last year, in January, we had 13,000 unique visitors. January isn’t over yet, but [as of January 27], we’re at the highest amount of unique visitors we’ve ever had, and that’s 93,000.”

The participation rate and financial impact of war tax resistance are hard to measure. After all, war tax resistance is an act of civil disobedience that is technically punishable by law. Most people who participate don’t want others to know they’re doing it. “I don’t know what the number is,” says Lincoln. “But I think it’s safe to say [the number of war tax resisters] is in the tens of thousands. We might be nearing a point in the near future where it’s adding another zero.”

I’ll give the same disclaimer three years in a row: I don’t want to persuade people to become war tax resisters. I completely understand people’s choice not to participate in this form of protest. But for people who are thinking of becoming war tax resisters, I want to make sure there’s a clear guide that outlines the risks and processes involved.

🧑🏫 On Thursday, Feb. 5 at 1pm EST, NWTRCC is hosting W-4 Office Hours. They’ll go over how to fill out your W-4 to withhold the percentage of your income taxes that get spent on military funding.

💼 I’ll be publishing a war tax resistance guide specifically for small business owners within the next two weeks. Make sure you’re subscribed to get the update.

🧮 For those who are interested in minimizing their tax liabilities by writing off more business expenses, I’ll be publishing a guide about that soon, too.

How much of my income tax goes to military spending?

To help people calculate exactly how much of their taxes fund war, the National Priorities Project created a calculator that shows taxpayers how their tax dollars are spent. You’ll need to provide your total taxes paid, which can be found on line 16 on your Form 1040, labeled “total tax.”

The War Tax Resisters League calculates present military spending to be 21% of the total federal budget. Past military spending, which includes $391 billion in veteran benefits and $1,023 billion paid in interest for debt accrued to fund past military spending.

Under Trump’s 2026 fiscal year budget, past and present military spending will cost 50% of the federal budget, up 4 percentage points from Biden’s 2026 budget.

How do I become a war tax resister?

In simple terms:

You choose a percentage to withhold. For example, you can decide to withhold 21% if you’re protesting current military spending, or the whole 46% if you’re against all military spending, past and present.

You fill out your tax forms to withhold that percentage. For example, if you owe $10,000 and you want to withhold 46%, you’ll pay $5,400 and carry a balance of $4,600 with the IRS indefinitely.

Self-employed people have an easier time withholding part of their taxes, but W-2 hourly or salaried employees need to fill out their W-4 form in a particular way to withhold part of their taxes.

Hourly or salaried workers can update their W-4 anytime.

For hourly or salaried employees who receive a W-2 form during tax season

Employees who receive a salary or hourly wage are required to fill out a W-4 form when they first start working for a business. The W-4 is a document that determines how much should be withheld from your paycheck for federal income taxes.

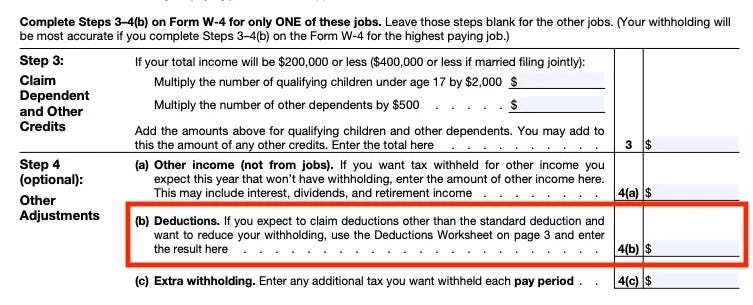

War tax resistance happens specifically in step 4, line b. This is the section you use to take “anticipated, legitimate deductions and tax credits,” says Lincoln from NWTRCC.

Here’s a step-by step process for filling out step 4, line b:

Start by pulling up last year’s tax return (Form 1040). This will help you estimate how much of your income might get taxed this year. You’re looking for the following information:

Your deductions. Use this link to calculate your standard deductions per family size).

Your tax credits, for example, the student loan interest tax credit (Form 1098-E) or the electric vehicle tax credit (Form 8936).

Next, make a list of your deductions and tax credits. Update the deduction and tax credit amounts for the current tax year.

If you weren’t planning on becoming a war tax resister, you would take that updated deduction and tax credit amount and put that total on step 4, line b. To withhold some of your taxes to protest military spending, increase the deductions you plan on taking on this line.

The math gets complicated here because the amount of taxes withheld also depends on your tax bracket. If you were to talk to a tax professional or a coordinator at NWTRCC, I recommend having the information from your 1040 before scheduling an appointment.

Subscribe to receive a guide specifically for self-employed workers and small business owners

Since self-employed workers receive payments before taxes are withheld, self-employed workers have a simpler route to war tax resistance. To become a war tax resister, you simply have to underpay your quarterly estimated taxes, or pay less than what you owe.

The general rule of thumb for people who receive a 1099 tax form from clients is that you will owe between 30-35% of your profit (revenue minus expenses) to the IRS due each quarter. For example, if you earned a profit of $12,000, you will likely owe $4,000 in taxes, and your quarterly payments will be $1,000.

Many war tax resisters are withholding between 20 to 50% of their taxes owed this year. So in this example, you’ll withhold 50% of $1,000 each quarter, which means you’ll write a check worth $500 — 50% of your taxes owed that quarter — to the IRS.

Please note: These numbers are simply estimates and hypothetical examples. Everything here is for educational purposes, NOT advice.

Is there a legal way to become a war tax resister?

The only legal way to become a war tax resister is to earn less than the minimum income required to file taxes. Simply put, single people who earn $15,750 or less per year do not need to file their taxes, and they likely will not owe any taxes. Their decision to earn less than $15,750 to avoid paying taxes is the only legal way to become a war tax resister.

The income threshold for married people filing jointly is $31,500, according to the IRS.

Some low-income earners might still be eligible for refunds, so most tax professionals still recommend filing a tax return even if you make less than the IRS filing thresholds.

War tax resistance organizations like NWTRCC recommend filing your taxes if you might receive a refund.

I am owed a tax refund this year. Should I still become a war tax resister?

There’s a big difference between filing your taxes and paying your taxes. While some war tax resisters choose not to file their taxes at all, many still do — especially if they are owed a tax refund.

The Tax Resistance Collective says in a video, “We are NOT trying to push people to not file at all, especially if you’re in the case of owing little to nothing or are in line for a refund. Even if you’re somebody who decides that you want to withhold all of your taxes owed, you can and probably still should file. It’s safer down the line.”

I already filed my taxes. Is it too late to become a war tax resister?

Again, filing your taxes is different from paying your taxes. If you owe taxes and you still haven’t paid, you are in a position to withhold your taxes, if you choose. If you received a return, the best course of action is to change your withholding for future years “so that you’re not giving the government an interest-free loan,” says Lincoln.

I want to become a war tax resister, but my spouse doesn’t. Should we still file taxes together?

Lincoln says that filing taxes separately from your spouse might protect them from tax liability.

He adds that war tax resisters can technically transfer their assets to their non-tax-resisting spouse to protect their assets. However, transferring assets to your non-tax-resisting spouse’s name wouldn’t make a difference in community property states, like Wisconsin, where assets and debts acquired during a marriage are considered the equal responsibility of each person in the marriage. If the state you live in is a community property state, the government can technically seize your assets regardless of whose name is on the deed.

Another thing to consider is that married couples filing taxes separately will not qualify for Obamacare subsidies.

Should I also withhold my state taxes?

The IRS moves so slowly that it can take years for the IRS to collect unpaid taxes and penalties. In contrast, Lincoln says state taxes operate differently.

He tells Queer and Trans Wealth, “There’s someone that I was close with here in Wisconsin. He was not a war tax resister. He was a chiropractor who was not paying federal and state taxes. When it was discovered, the federal government just made him pay the money. It wasn’t a big deal. But with the state of Wisconsin, he did two years in jail.”

Will I go to jail? Will the IRS take my house or my car? What’s the worst that can happen?

The last record of someone going to jail for being a war tax resister was in 1974, says Lincoln Rice of the NWTRCC. Martha Tranquilli of Sacramento was convicted of “tax fraud” because she claimed six peace groups as dependents on her Form 1040.3 Lincoln also says that the IRS stopped prosecuting war tax resisters because the government found that it only heightened publicity and interest for the cause. Additionally, the last time the IRS seized property, like a house or a car, was in 1998.

In 2025, I asked Lincoln if any of the estimated 10,000+ war tax resisters from the 2023 tax season had faced any repercussions. He said only two people faced consequences, and those two people are long-term tax resisters.

He says, “One person had their bank account levied, and another person had an investment account levied. Both individuals were people who have been war tax resisters for over 30 years. Both of them have been previously collected on, but it had been 15 to 20 years since they’ve been collected upon.”

That being said, the legal repercussions of going to jail or having your property seized still remain in place. While the risk is always there, the occurrence of these consequences is statistically rare.

In 2026, Lincoln added, “[War tax resistance] is different than robbing a bank. If you rob a bank, it doesn’t matter if you bring back the money… you’re going to jail. You’re going to be prosecuted. But war tax resistance, [the IRS] just wants the money. If there comes a time in the future when you’re like, ‘I’m uncomfortable with this… it’s causing too much stress.’ You can always say, ‘I’m going to pay,’ and the IRS would be happy to make everything go away.”

What are the actual risks?

After withholding your taxes to become a war tax resister, you’ll likely receive computer-generated letters from the IRS demanding that you pay what you owe.

Lincoln Rice of NWTRCC says, “I’ve been a war tax resister since 1998, and every year, when I get my letters from the IRS, my heart still skips a beat. That just seems to be ingrained in our DNA. If you were raised in the United States, you fear the IRS. The IRS knows that [that fear is] effective.”

Many people irrationally fear the worst: Getting arrested or having your assets seized if you don’t pay taxes. These two outcomes rarely happen, but here are more common and immediate consequences:

You may receive computer-generated letters from the IRS demanding that you pay what you owe.

Your wages or Social Security benefits may be garnished by 15% within a year.

Your retirement or investment accounts may be levied. A levy is a legal seizure of your property to satisfy a tax debt.

Interest or penalties are charged – you’ll probably see your tax debt double.

You might have difficulty getting student loans

Public lien that can affect your credit

You may lose your passport for debts over $64,000

What is the actual likelihood of being audited by the IRS?

A 2023 report by the Congressional Research Service showed that less than 1% of tax returns were audited in 2019. Of that 1%, the income bracket that was audited the most was people who earned $5 million or more.

People who earned $500,000 or less only made up 0.64% of the small pool of taxpayers audited in 2019.

Statistically, it is rare for people who make $500,000 or less to get audited by the IRS.

Is the IRS using AI to find war tax resisters?

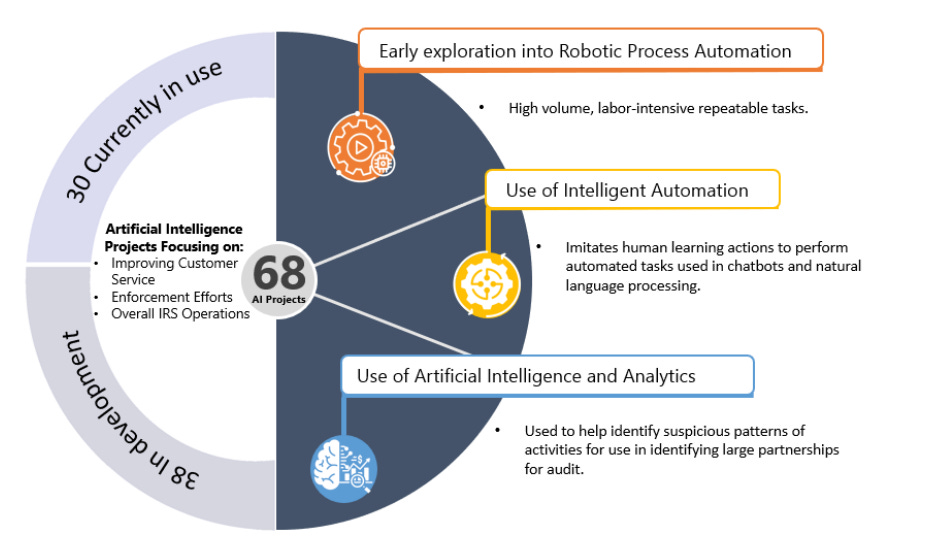

The IRS has used basic artificial intelligence since the 1980s, specifically to speed up tax processing. According to a report by the Treasury Inspector General for Tax Administration, the IRS initiated 68 AI projects in 2024.

In 2023, the Biden administration announced that it was using AI to identify “sophisticated tax processes” that wealthy people use to avoid paying taxes. At the time, the IRS said it would ensure that audit rates don’t go up for people who earn less than $400,000 per year.

Under the Trump Administration, it’s unclear whether AI use within the IRS will have any safeguards, transparency, or accountability when it comes to auditing lower-income taxpayers.

For war tax resisters, the fear of being identified by AI is valid. Lincoln from NWTRCC says, “We always recommend, in most cases, to file accurately. Since war tax resisters normally file accurately, [the use of AI by the IRS] wouldn’t affect them.”

Can I become a war tax resister if I have a government job?

According to the IRS, workers in the Treasury Department may be fired if they willfully owe tax debt.

In June 2024, the Trump Administration, with the help of the IRS, sent an LT36 notice to 525,000 government workers with outstanding tax liabilities, reports Reuters. The letter urges government workers to “lead by example,” threatening to follow up with each employee directly if workers do not make any attempts to pay their debts.

The LT36 notice was sent in the middle of the Trump administration’s aggressive layoffs of government workers.

“For federal employees, things have become murkier,” Lincoln says. “You are much more likely to receive a wage garnishment in a quicker amount of time. We haven’t seen this issue for people who are state or municipal employees.”

On social media, activists have been suggesting withholding all income taxes and putting the money in a high-yield savings account. Are there any risks with that method?

When you file exempt in an effort to pocket your entire paycheck before taxes, they put down $0 under line 4b on their Form 1040.

By putting down $0 on that line, you are effectively telling the IRS that you didn’t owe taxes this year, and you don’t expect to owe taxes this upcoming year. Lincoln says, “It’s a possible extra perjury charge when you mark exempt… again, we haven’t seen anything happen with that, but the risk is just greater.”

Lincoln also says that putting the taxes you owe in a high-yield savings account makes sense if war tax resistance is a short-term strategy for you, and you plan on repaying your tax debt after a number of years. War tax resisters usually redirect the tax dollars they withheld to anti-war groups that are not properly funded, says Lincoln, “to show that you’re not just doing it so that you have more money to yourself.”

Will I lose my EBT, Medicare, or Social Security benefits?

In some cases, you may lose your EBT or Medicare benefits. You won’t lose all of your Social Security benefits, but your benefits may be levied by the IRS. This means that the IRS will take the amount that you owe from your Social Security benefits.

How will war tax resistance affect my student loans?

If you’re paying back your student loans, your monthly payment is calculated based on your most recent adjusted gross income (AGI) on your Form 1040, line 11. From my research, war tax resistance does not affect your eligibility for income-driven repayment plans, but it affects the amount you owe each month.

Should DACA recipients become war tax resisters?

Lincoln says that NWTRCC hasn’t heard of DACA recipients facing any consequences yet, especially under the Trump administration. However, he says there’s a possibility that war tax resistance will stop someone who isn’t a US citizen from reentering the country if they leave the US at any point.

He says, “Even if all your paperwork is in order, if the person handling your reentry into the United States decides to check with the IRS if you have debt, it could be used to deny reentry to the United States… That’s definitely a much higher risk than the average person faces.”

How do I talk to my accountant about war tax resistance?

Lincoln Rice at NWTRCC says that most accountants don’t really know about war tax resistance. Accountants may fear legal repercussions of filing taxes “incorrectly.” In this instance, it might be beneficial to talk to a war tax resistance counselor through NWTRCC in addition to your accountant.

Does withholding my taxes actually make an impact on the IRS?

It’s difficult to track how many people are actually war tax resisters because this is an act of civil disobedience punishable by law and because people owe such varying amounts each year. This makes it almost impossible to discern whether or not war tax resistance is making enough of a “financial impact” to actually stop sending weapons to Israel or to stop the Trump regime from enacting any more harm to marginalized communities.

In my work as an anti-capitalist financial coach, I help my clients hold the complex reality of how much their values-aligned actions impact their own financial wellbeing versus the systems at large. It is completely understandable to feel like war tax resistance might not be worth it if we can’t measure how it’s affecting the American empire.

But at this point in history, revolution requires risk — and you don’t have to go through this alone. 🫂