5 common credit card payoff strategies

and how to choose the best one

Hello to the 1,092 hotties who subscribe to this newsletter! Thank you for being here.

I feel like a broken record for saying this, but… It is still wildly dystopian to me to be writing about credit card debt when Palestinians in Rafah are still under attack, over 34,800 Palestinians have been killed, and, as I write this, an oppressive heatwave is forcing schools in Southeast Asia to close because it is literally too hot to function.

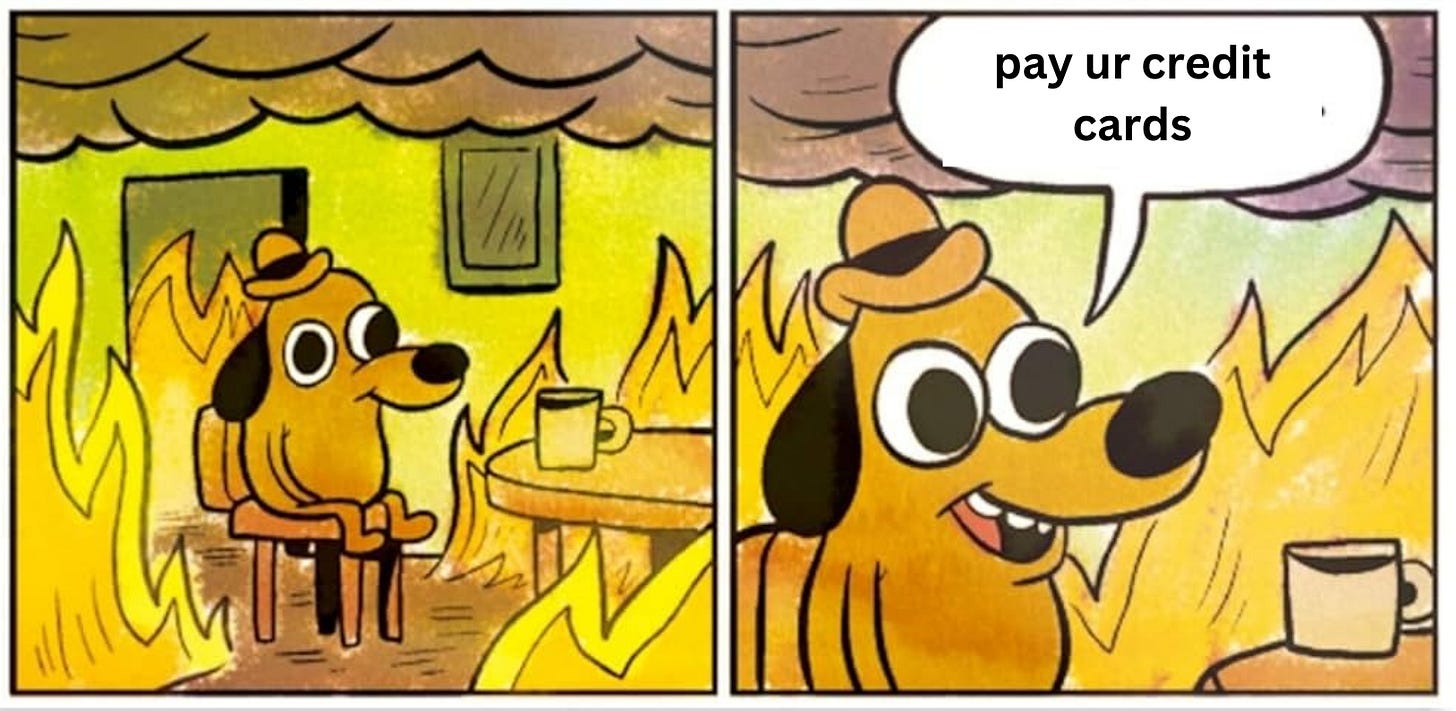

I’ve never felt more like this dog:

Regardless of how I feel, I know there are so many people showing up for Palestinians right now, rain or shine, despite their economic disadvantages — especially college students, many of whom are in debilitating student loan debt.

I only wish that this newsletter breaking down common debt payoff strategies lightens the load of any financial burdens you are carrying, dear hottie, so that you may show up for your liberatory work with more ease and confidence.

First things first: Know your interest rate

Before picking a debt payoff strategy, you first need to pull up your credit card statements and find your interest rate, typically expressed as an APR in your monthly statement.

You’ll want to organize this information about each of your credit cards:

Creditor (for example, JP Morgan Chase, Wells Fargo, Bank of America, etc.)

Credit card balance - the full amount that you owe

Interest rate

Minimum monthly payment

For example:

Should I stop using credit cards altogether?

That is entirely up to you, my friend. This decision depends on your personality type, and your end goal with using credit cards.

Some people want to use credit cards to build or rebuild their credit so they can access housing, while some people want to use credit cards to play the travel points game and get free shit.

I understand those desires, but, at the end of the day, you should make this decision based on what kind of spender you are & the nature of your relationship with credit cards at this very moment.

If you are an impulsive or emotional spender, using a credit card to play the travel points game is a fever dream, my friend. It’s likely not going to work for you until you change your relationship with credit cards altogether.

I’ve seen people try to maneuver the credit card points game, thinking aspirationally that their habits will somehow change, and that is simply unrealistic. These folx dig themselves a deeper hole with their debt, and I don’t want it to happen to you. I really encourage you to get honest with yourself and choose a strategy that works for you right now.

Without further ado, here are 5 common credit card payoff strategies:

1. The debt avalanche method

With the debt avalanche method, you pay the minimum on all of your debts and put any extra amount toward the debt with the highest interest rate first. Start by organizing your debts from highest to lowest interest rate.

For example:

Let’s say you have $800 in your budget allocated to paying down debt, $211 more than the minimum payments due each month. You’ll put that extra $211 into the Discover card each month until you’ve paid off the balance, and continue to pay the minimums on your other cards.

Pros: You pay less interest over time.

Cons: If your debt with the highest interest rate also happens to be the debt with the largest balance, you’ll experience delayed gratification.

Good for: People who enjoy edging (lol), people who are more concerned with the total payoff than milestones over time

2. The debt snowball method

With the debt snowball method, you pay the minimum amount on all of your debts and put any extra toward the debt with the smallest balance first.

For example:

Again, let’s say you have $800 allocated in your budget for paying down debt, $211 more than the monthly minimums due. You’ll put the extra $211 into the Apple credit card each month until it’s paid off while paying the minimums on your other credit cards.

Pros: You gain momentum to pay off your debts.

Cons: You may pay more interest over time. It can be tempting to prioritize your debt over living life once you see the momentum. Next, you may feel like you deserve to use your card for a lil treat to celebrate paying it off.. and, next thing you know, the debt cycle starts all over again.

Good for: People who are motivated by small wins.

3. Consolidating your debts

With this method, you’ll consolidate your credit card debts into one personal loan. Instead of owing money to 4 different companies and dealing with multiple interest rates, you’ll owe one big debt to one creditor with one interest rate.

What you need to know:

This method only works for people who have fair or good credit. People who have poor or no credit history may not qualify.

Applying for a personal loan to consolidate your credit card debts will lower your credit score by 5 to 10 points. The initial application will use a soft credit inquiry, which doesn’t affect your credit score. But the complete application will use a hard credit inquiry, which lowers your credit score by a few points.

There may be origination fees to consolidate your credit card debt into one personal loan. Sometimes, personal loan companies charge an origination fee for consolidating your credit card debts. For example, if you’re charged a 10% origination fee on $19,200, you’ll end up paying $1,920 in fees. Depending on your lender, that $1,920 can be added to your loan balance, or it’ll be divided into smaller increments (usually the number of months in repayment) and added to your monthly balance.

There are credit card consolidation personal loans made for people with specific credit scores. Someone with a 650 credit score likely won’t get approved for a personal loan designed for someone with a credit score of 775 or higher. Someone with an 800 credit score may get approved for a loan designed for someone with a 650 credit score, but they’ll probably get less favorable terms than if they applied for a personal loan designed for their credit score. Use this search phrase to find the best personal loans for your credit score: “best credit card consolidation loan for [insert credit score here] credit score”

Consolidating your credit cards into one personal loan wipes out your credit card balances. Many of my clients come to me saying that they’ve done a consolidation loan before, and that they managed to run the balance up on their freshly-wiped-clean credit cards all over again. Unfortunately, there’s no shortcut for avoiding that trap. You just have to do the hard work of changing your relationship to credit cards alongside this credit card payoff strategy.

Your credit score will go up dramatically after you consolidate your loans. Because a consolidation loan wipes your credit card balances clean, your credit score will go up. This is perfect for people who need to raise their credit score so that they can access better housing or loan options if they’re about to make a big purchase, like a car, for example.

Pros: Payments tend to be more manageable and predictable once you’ve consolidated your credit cards into one personal loan.

Cons: It may be tempting to use your credit cards again after your balances are wiped clean from the consolidation loan.

Good for: People who want to stop using credit cards altogether. People who need more manageable and predictable monthly payments.

4. Credit card balance transfer

Some credit cards offer 0% APR for the first 12 to 15 months that the card is open. A credit card balance transfer is when you transfer the balance from an old credit card to a new one, taking advantage of that 0% APR introductory period to make more progress on paying down debt.

Using our same example, if you make $350 minimum payments on your Discover card with 29.99% interest, it’ll take 77 months to pay off the balance, and 54% of those monthly payments will go toward paying down the interest.

With a balance transfer, you can make a bigger dent in paying down the principal balance of your credit card because of the 0% APR offered in those first months. In this example, if you continue making $350 payments, you’ll lower the principal balance by $4,200. Even with the same interest rate of 29.99% kicking in after the introductory period and the same monthly payment of $350, you’ll pay off your debt in 45 months instead of 77.

5. The virtual envelope system

Back when using cash was more common, people would separate budgeting categories like rent, utilities, groceries, and dining out into physical envelopes. Those physical boundaries helped people understand that, if you overspend on dining out, you literally have to take that money from somewhere else in your budget, like rent or utilities.

The virtual envelope system involves opening multiple bank accounts that serve as those envelopes. You’d need to have at least 3 bank accounts:

One checking account for recurring expenses like rent, utilities, subscriptions, and debt payments. Ideally, this checking account does not have a debit card attached to it.

One savings account for your emergency fund. Ideally, this savings account is not linked to your checking account so that it’s less tempting to withdraw from it.

One checking account for your variable spending, like groceries, dining out, entertainment, and more. This account will have a debit card attached to it, and, ideally, to keep things simple, this will be the only one you carry while you’re out running errands and living life.

Small business owners will probably have separate accounts for their business. People with multiple savings goals might have multiple savings accounts for different purposes.

If you’re a W-2 worker with a steady paycheck, and if your employer has the option to allocate your paycheck to different accounts, you can set it up so that the appropriate amounts are directed in each account.

For example, if your rent, utilities, and subscriptions add up to $2,700 and you want to allocate $800 to paying down debt, that first checking account for recurring expenses will automatically get $3,500, which breaks down to $1,750 per paycheck.

If you want to save 10% of your income after taxes to build up your emergency fund, you’ll automate 10% of each paycheck to your savings account.

Pros: Set it and forget it. It’ll take some time adjusting to the new boundaries that you’ve set for yourself. But ultimately, the virtual envelope system will help you automate your debt payments so you don’t even have to think about it.

Cons: This only works if you have a steady paycheck, and if your salary gives you enough money to live comfortably. This method can easily be used for self-deprivation. This method also typically doesn’t work for freelancers or business owners who have irregular income.

Good for: People with a steady, bimonthly paycheck who want to be completely hands-off with their money.

If this post helped you, please consider sharing it with a friend, upgrading to a paid subscription, or buying me a coffee. If you need extra support, consider signing up for a 1:1 session with me.

See you next week,

Leo <3