Biden might have miscalculated your student loan payments 🤡

+ ways to support Palestine

7-minute slow read. There is also a recording of this newsletter above for accessibility. Please let me know if you have any other access needs.

Hello to the 673 hotties who subscribe to this newsletter! And congratulations to Nilaja (@insomniacraftshop on Instagram), the winner of the Janelle Monáe concert ticket giveaway last week!

Before we get into the nitty-gritty on student loans…

I want to remind you about three ways you can support the people of Palestine for $26 or less:

Read about the genocide of Palestinian people at the hands of an apartheid Israeli government. Please be careful about where you source your information. Journalists are being irresponsible about media coverage of this genocide. Reliable sources are listed within this post and at uscpr.org/FollowGaza.

Call Congress to demand a ceasefire in Gaza and/or show up to a protest near you.

The US gives $38 billion in taxpayer money to fund Israeli military aid. The average individual taxpayer gives $25.25 in weapons to Israel each year. To offset that impact, donate $25.25 or more to organizations like iF Charity and Palestine Child Relief Fund, which provide medical support, food, and supplies to Palestinians in the Gaza Strip.

A little bit of good news before moving onto student loans:

I’m the new editor-in-chief of Queerency.com, a media company reporting on the queer economy! Read my first editor letter here, and feel free to send me any feedback, suggestions, or tips at leo@queerency.com.

I also recently got into the Roots. Wounds. Words. Writers’ Retreat — a winter residency for writers of color! While there, I’ll be working on my first nonfiction book about anti-capitalist personal finance.

I received a partial scholarship, and was able to pay the deposit required. I need to raise an additional $250 by November 17 and $250 by December 1 ($500 total) for the remaining tuition. If you are able, please consider supporting my work by giving money to this fundraising campaign via Give Lively.

Back to student loans:

After a 3-year interest-free break from paying student loans, monthly payments resumed on October 1. The Biden Administration rolled out the SAVE Plan, a new income-driven repayment plan that promised to slash borrowers’ payments by at least half. On October 8, The Washington Post reported that about 420,000 Americans were given the wrong student loan monthly payment amount.

To calculate each borrower’s student loan payments, servicers need the following pieces of information:

Your annual gross income (AGI) listed on your most recent tax return. This can be found on line 11 of your IRS Form 1040.

Your family size

The 2023 federal poverty guidelines for your family size, listed by the HHS

Student loan servicers used the 2022 federal poverty guidelines by mistake instead of this year’s figures, which is why 420,000 Americans might have paid more than they actually owe. CNBC reports that one borrower was charged $2,000 per month instead of the $400 bill they were anticipating.

Experts say that student loan servicers were simply not ready for payments to start again after 3 years of forbearance.

It infuriates me that working-class Americans all over the country scrambled, panicked, and picked up extra shifts at work to prepare for student loans to return on October 1st, yet student loan servicers weren’t ready either.

Alas, these miscalculations are out of our control. Organizations like the Debt Collective and the Student Borrower Protection Center (SBPC) are hard at work advocating for debtors’ rights, and we need to focus on what we can control.

What you need to know about miscalculated payments:

If you’re one of the affected borrowers, your servicer should have already placed you on an administrative forbearance until they correct your monthly payment amount. During an administrative forbearance, payments are automatically paused, though it is unclear whether or not your loans will continue to accrue interest.

Besides the administrative forbearance, remember that we are still within the 1-year “on-ramp” period where missed payments will not hurt your credit report nor lead to delinquency.

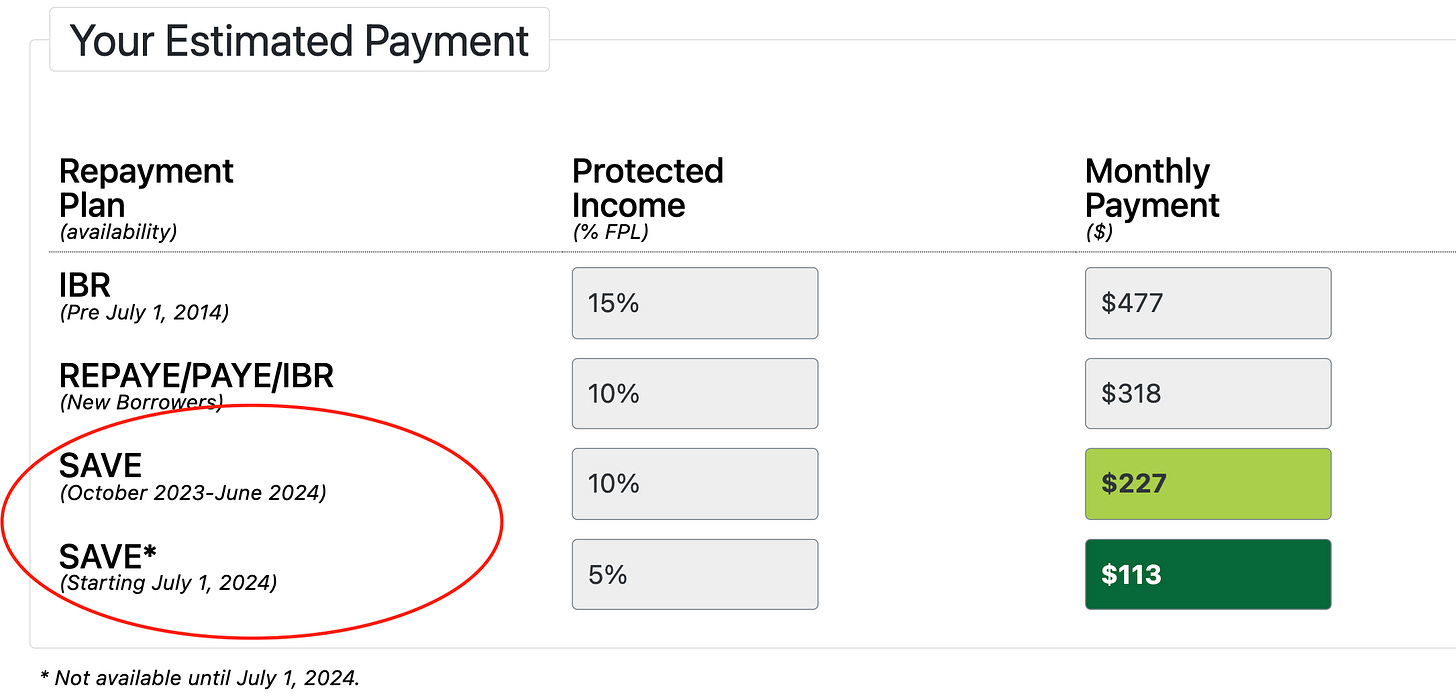

Biden’s SAVE Plan promised to slash monthly payments by half, but you won’t actually see those promised savings until July 1, 2024, when the SAVE Plan is fully in place.

You can calculate your own payments using the SAVE IDR Plan Calculator by the Education Debt Consumer Assistance Program (edcap). This is the only calculator I trust, and I’ve double-checked the math. edcap even calculates what your monthly payments are supposed to be before and after July 1, 2024.

Finally, a gentle reminder: The inability or refusal to pay your student loans is not a moral failure. You are not a bad person if you can’t or choose not to pay your student loans back.

Til next week, hotties <3