Correction: Here's how you should budget your 2024 tax return

for 12 different circumstances & financial goals

Hello to the 2,997 hotties who are reading this newsletter! Thank you for being here.

Correction: On January 28, I sent out a newsletter with a mistake. I mentioned that investing in your Roth IRA can help offset any taxes owed for 2025. This is incorrect. Investing in a Traditional IRA can offset taxes owed for 2025. For 2025, the maximum amount you can deposit is $7,000 if you’re under the age of 50. If you’re over the age of 50, the maximum amount you can deposit is $8,000.

I want to thank the people in the comments and in my inbox for pointing out my mistake. I’m sorry I made this mistake! There’s no excuse. I should have slowed down while writing this newsletter.

Here’s the original post with the corrections made:

It’s tax season! As your W-2 and 1099 forms start coming in the mail, those of you who are lucky enough to get a tax return are probably daydreaming about how you’re going to spend that influx of cash.

About 75% of the people who read this newsletter and follow Queer & Trans Wealth on Instagram want to give money to mutual aid… but don’t have any plans to tackle their five figures of credit card debt or build an emergency savings fund. You might find some kind of moral conundrum around taking care of yourself financially because of scarcity mindset under capitalism.

The remaining 25% of this community is on their way to achieving big savings and retirement goals by listening to personal finance podcasts on their morning walks. You might have difficulty letting go of some of your hard-earned cash because of… surprise, surprise: a different strain of scarcity mindset under capitalism!

This is a safe space for both groups, and I’m about to give you some real talk. Here’s how you should spend your 2024 tax return. This guide includes colorful pie charts (!!!!) and personalized suggestions for 12 different financial circumstances and savings goals.

💌 Coming soon: I’ll tell you how to file your taxes for free, make a payment plan with the IRS, and become a war tax resister. Make sure you’re subscribed, and click these links for last year’s guides.

🤝 I’m still accepting new clients! If you need a financial coach for the next 3, 6, or 12 months, email hello@queerandtranswealth.org for more info on my services. You can also book a time to meet with me using this link.

Before we get into each specific financial circumstance or goal, here are a few ground rules…

Plan to use 10% of your tax return on a splurge purchase

You were probably going to do it anyway ¯\_(ツ)_/¯ If you plan for it beforehand, you’ll feel less shame and guilt for spending money on something fun later on. Each plan below includes a 10% buffer for splurge spending on things like new boots, a cheap flight to a different state or country, or concert tickets for Taking Back Sunday’s upcoming tour with Coheed and Cambria. (Are any other former emo kids as excited as I am about this one?!).

Some of y’all can’t afford to give mutual aid right now

You’ll notice that only 4 out of the 12 tax return budgets below include giving mutual aid. This recommendation is based on some things I’ve witnessed in my financial coaching practice. People with high debt burdens and little to no emergency savings are more inclined to give mutual aid because they empathize deeply with people going through difficult times. In contrast, people with more financial security are so wrapped up in a scarcity mindset that they hoard their wealth.

Let me rip the band-aid off and give you some exact figures:

High debt = $7,500 or more in credit cards or loans with an interest rate of more than 6%

No savings = literally $0 in a savings account; maybe you haven’t even opened one

Some savings = at least $2,000 for emergencies for single people; at least $5,000 for couples, polycules, or people with kids

Fully-funded emergency savings = you have enough saved to cover 3 to 6 months of living expenses in case of an emergency

Passive income sources = you inherited some money from a relative or you have a source of income that you don’t have to work for (ie, income from rental properties, dividends, or family businesses)

If you have high debt or no savings, you cannot afford to give mutual aid right now. You need to have enough cash on hand in case you need to pack up and move to a different state suddenly, or if you’re evacuated from your home due to a natural disaster.

If you have at least two month’s rent in your savings account, a retirement plan, and/or one or more sources of passive income, you need to give mutual aid now more than ever. Don’t let your corporate job or middle-class upbringing distort your view of reality. I can assure you that you have more than enough money. You have your basic needs met and you can afford to postpone a fun savings goal to show up for your community.

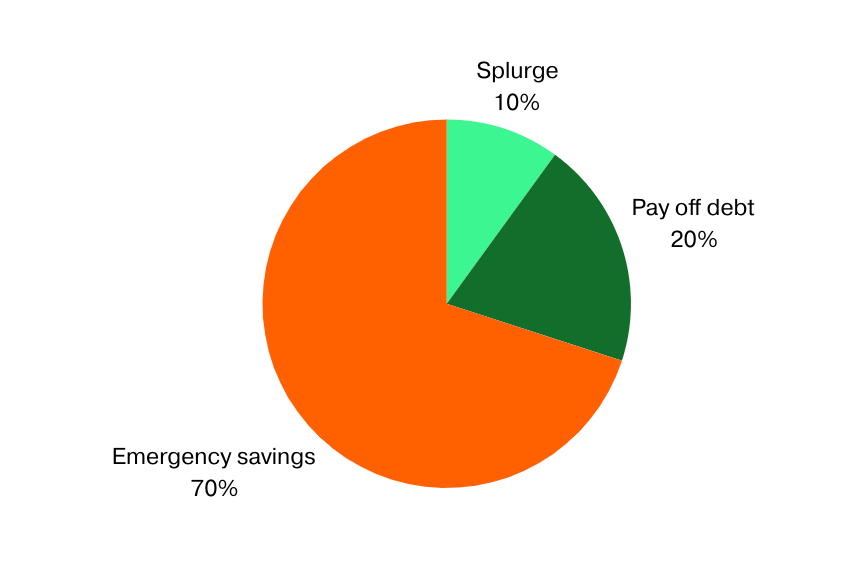

If you have high debt and no emergency savings…

Don’t throw your entire tax return at your debt. Your emergency fund will keep you from getting into more debt in the future and give you some peace of mind in case of an emergency.

If you have low debt but no emergency savings…

I know there’s a huge sense of accomplishment that comes with paying off that last $2,000 worth of debt, but you need savings, friend! I still encourage you to set aside majority of your tax return for emergencies if you don’t have savings right now.

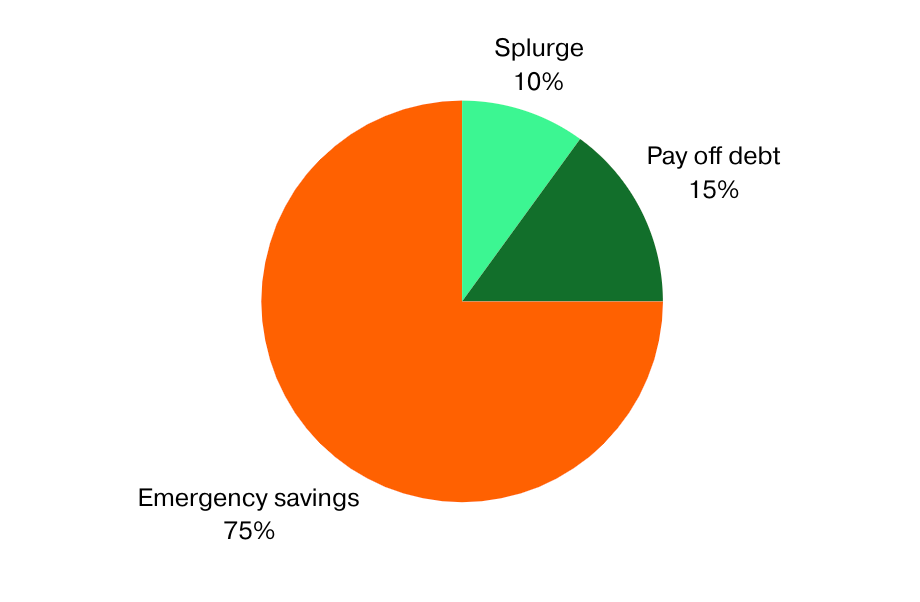

If you have low debt and some savings…

If you already have at least $2,000 in your emergency fund, use more of your tax return to pay off your debt.

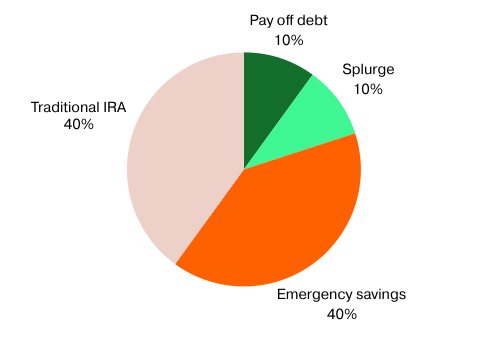

If might owe taxes in 2025…

If you were laid off at the end of the year or if you finally quit your 9-5 to start your own business or freelance art practice, you might owe taxes in 2025 instead of getting a tax return.

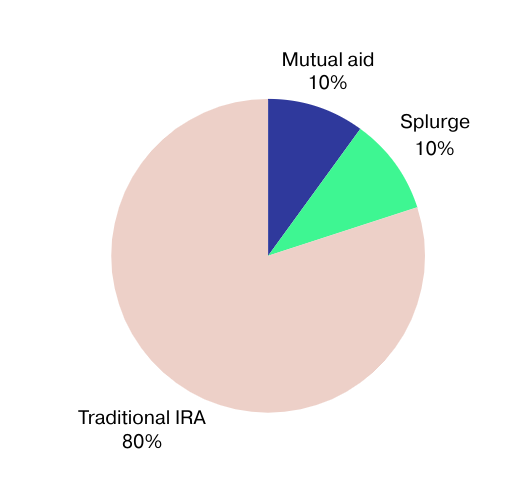

To prevent tax debt, max out your Traditional IRA, a retirement account with an annual limit of $7,000 for people under the age of 50. If you’re over the age of 50, the annual limit for your Traditional IRA is $8,000. Investing in retirement lowers your taxable income, which, in turn, lowers your tax liability.

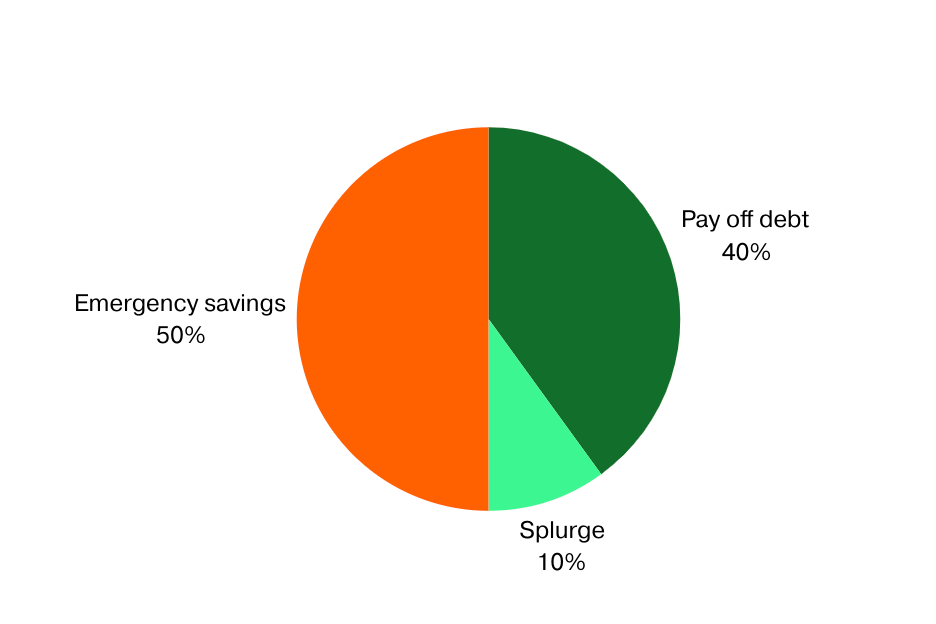

If you’ll owe taxes AND have high debt and no emergency savings…

You know the drill at this point. Use your tax return to pad your emergency savings and prevent tax debt down the line.

If you might owe taxes in 2024 AND have low debt and some emergency savings…

Use most of your tax return to invest in your Traditional IRA, but use a portion of your tax return for mutual aid.

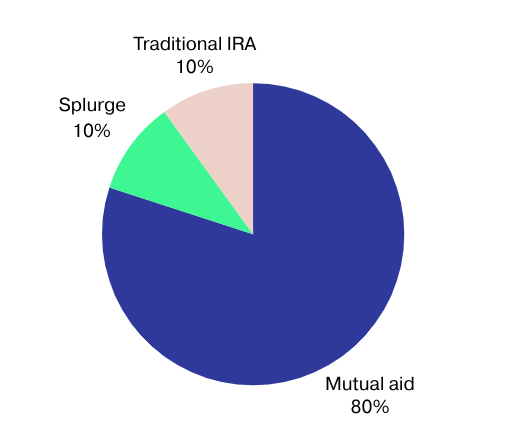

If you have no debt & fully-funded emergency savings…

Some people who have managed to pay off their debts and save 3-6 months of living expenses are on an ego trip. “I did that all by myself! If other people worked just as hard, they would be able to do it, too. Why should I help?”

That’s not the vibe, sweety. In this economy, the ability to save money and pay off debt is a privilege. Yes, you worked really hard. But you’re also likely in that position due to many layers of privilege that you aren’t willing to acknowledge.

It’s time to give mutual aid.

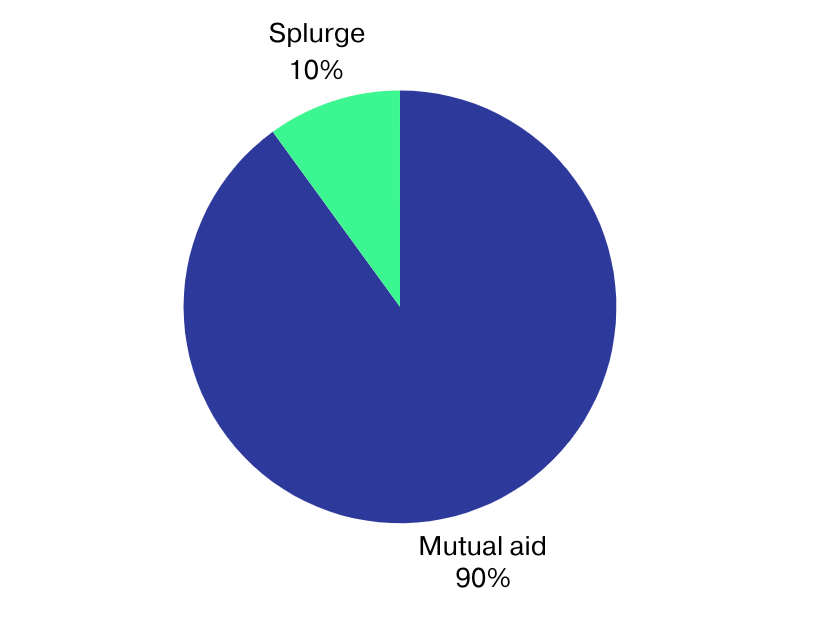

If you have no debt, fully funded emergency savings, and at least one source of passive income

Your passive income sources can be parlayed into retirement funds down the line. I encourage you to give 90% or more of your tax return to mutual aid.

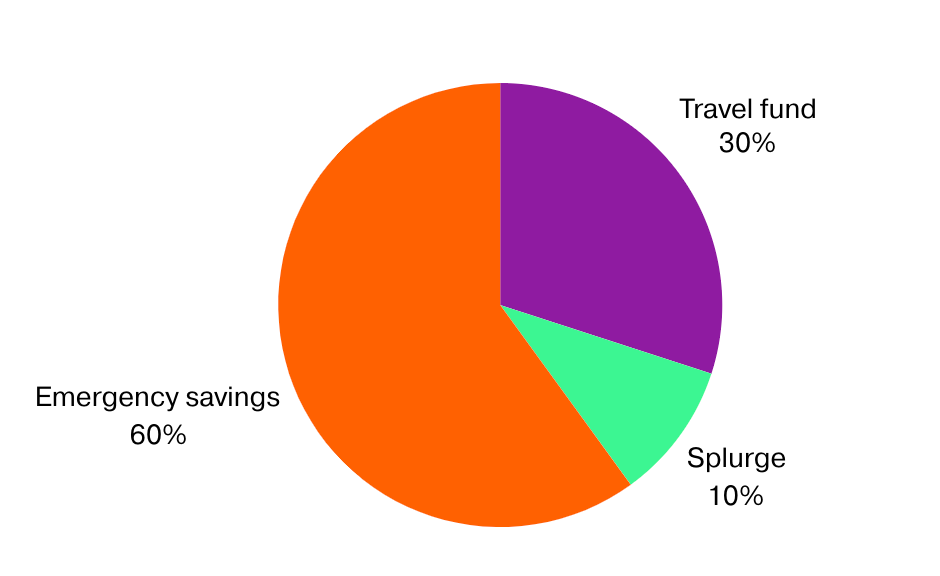

If you’re saving for travel but don’t have emergency savings…

I’m not a total killjoy. I think you should see some of the places on your bucket list before climate catastrophe demolishes them! (I wish I was joking, but the wildfires really did a number on me, y’all.) This plan allows you to balance both travel and emergency savings.

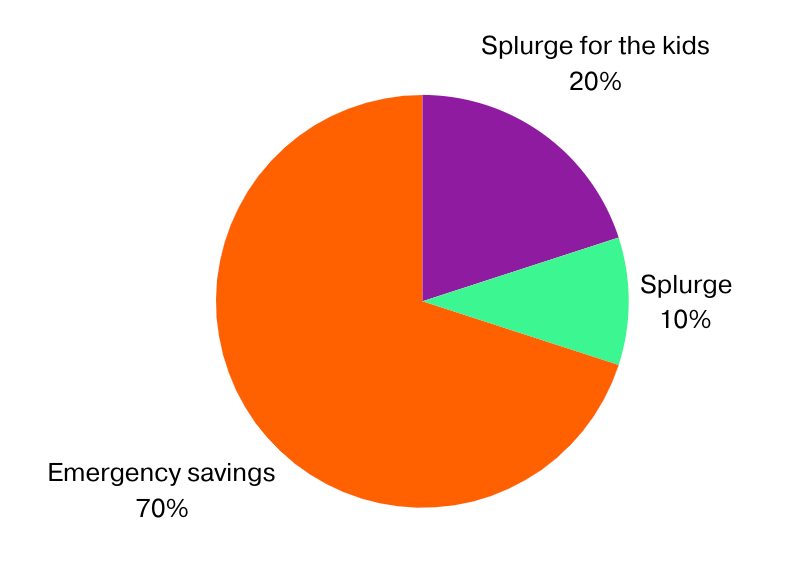

If you have kids but don’t have an emergency savings fund…

The 10% splurge budget is an act of self-love. You’re allowing yourself to be human and forgiving yourself for any past money mistakes. Why not teach the kids an early lesson in self-love, too? This plan makes room for treating yourself and the kids to fun gifts and activities, while still prioritizing emergency savings.

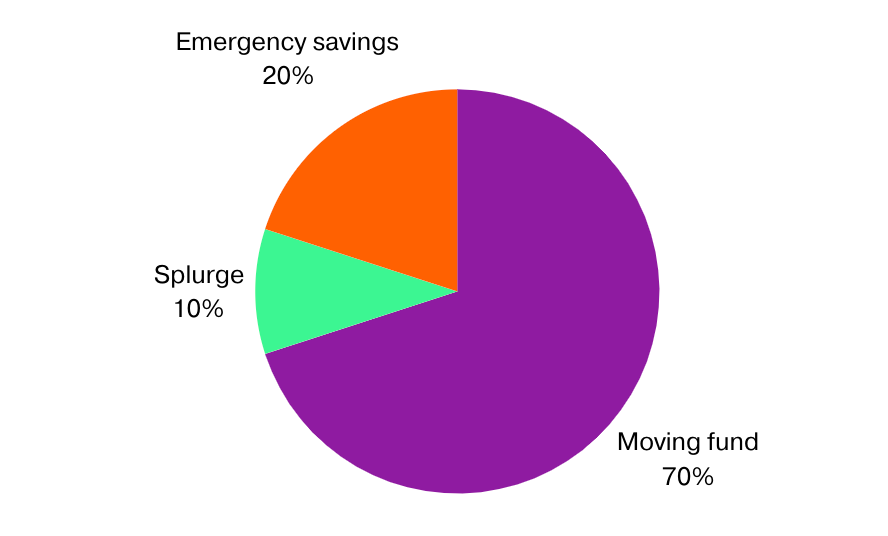

If you’re saving to move to a queer- or trans-friendly city ASAP…

Under the Trump Administration, moving to a queer- or trans-friendly state where you can make community is considered an emergency expense. Save some of your tax return for any emergencies that may arise while you move. Otherwise, prioritize any expenses associated with moving to that new state or city.

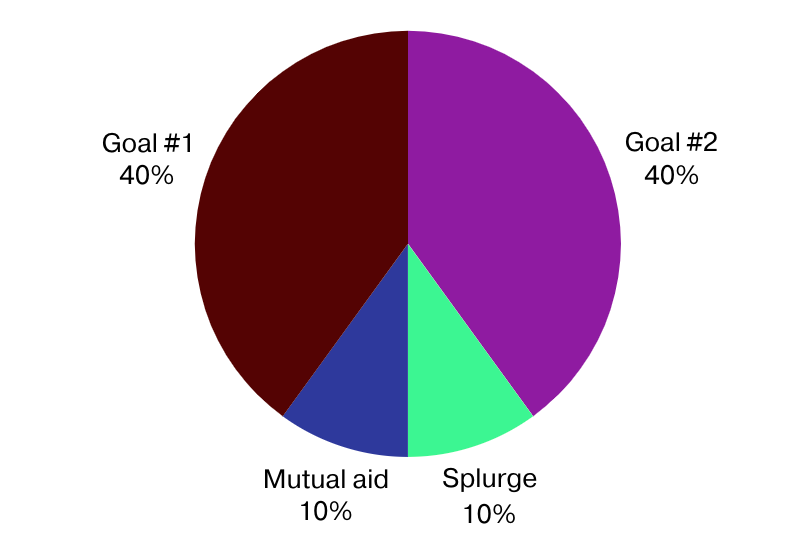

If you’re saving for multiple big goals at once…

This one’s for folx who are saving for multiple big-ticket items such as:

a wedding

the down payment on your first home

family planning (a single round of IVF can cost up to $40,000!)

gender-affirming surgery

There’s a 10% mutual aid bucket, because, again, the ability to save money is a privilege. This plan allows you to put money in different savings buckets while making room for mutual aid and splurge spending.

this is so fantastic

Thanks so much for the helpful information!