a student loan guide for procrastinators

it's a sh*t show out here 🫠

Hello to the 5,164 hotties who subscribe to this newsletter! Thank you for being here.

This guide is a doozy, so you might want to grab a cup of tea, a sweet treat, and a cozy blanket before getting into it.

You might have already heard: Under the Trump administration, the Department of Education began garnishing wages and tax refunds of borrowers whose student loans are in default on May 5.

Student loans in default have been transferred from a federal servicer to a debt collection agency. Default happens after 270 days (approximately nine months) of nonpayment. Out of the 42 million Americans who hold student loans, more than 5 million are currently in default. That number could swell to about 10 million within a few months1.

When the government promises to garnish wages, what they mean is that they will recoup what you owe by taking a cut from each paycheck without your consent. According to the Trump Administration, your annual tax refund is also up for grabs.

The Department of Education says notices have gone out to borrowers who have defaulted on their student loans, and that borrowers should contact Default Resolution Group to prevent consequences.

Here’s a guide for anyone who wants to avoid default, or for anyone trying to get out of default:

🤝 Now accepting 1:1 clients. I have space for new clients! You can book a two-hour session to lay out your budget for the year, or you can sign up for a 3-, 6-, or 12-month package by contacting us at hello@queerandtranswealth.org.

🧑🏫 Hire me to teach! I’ve taught workshops at the Leslie-Lohman Museum of Art, Cal State LA, UC Berkeley, Folx Health, Iowa State University, and Northwestern University. If you need a personal finance workshop for your organization, staff, or students, send us an email at hello@queerandtranswealth.org.

How to avoid defaulting on your student loans

1. Choose an income-driven repayment plan

President Biden introduced the SAVE Plan, which promised to cut monthly payments in half, in August 2023. Republican politicians have blocked the SAVE Plan from going into effect, and borrowers who opted in have been placed on an administrative forbearance until fall 20252.

While it seems like the SAVE Plan won’t come through for borrowers, other payment plans might suit your needs. You can view your payment plan options on studentaid.gov. Here’s an overview of each payment plan

Standard Repayment Plan

You’ll pay a fixed monthly payment for 10 years.

Pay as You Earn (PAYE) Repayment Plan

Under the PAYE Plan, your monthly payments are calculated using your annual gross income (AGI) on your most recent tax return. The PAYE Plan uses 10% of your discretionary income to calculate your payment, but your payment will never exceed the amount of the Standard Repayment Plan. The easiest way to calculate your payments is to use the Edcap NY IDR Calculator.

Depending on the age of your student loans, your repayment plans might be called:

Income-based repayment (IBR)

Income-contingent repayment (ICR)

Your monthly payments could be $0 if your AGI is less than 150% of the federal poverty guideline. For a single-person household, this means you wouldn’t have a monthly payment if your AGI is $23,475 or less. Below, I listed the income guidelines for family sizes up to 8:

Graduated Payment Plan

Under this plan, you start with lower monthly payments at first, then gradually increase the payment amount every two years.

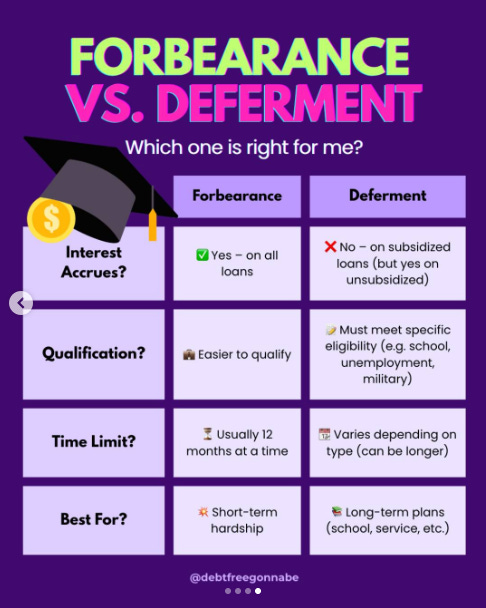

2. Put your loans on forbearance or deferment

General forbearance

Forbearance is a temporary payment pause on your student loans. Unless forbearance is given by the government, like the pandemic payment pause, interest continues to accrue on your student loans while you’re unable to pay.

You can request a general forbearance for the following reasons3:

Financial difficulties

Medical expenses

Change in employment

Forbearances are granted for 12 months at a time, but there is a cumulative limit of 36 months of forbearance on your federal student loans.

Contact your student loan servicer to request forbearance. You can find your student loan servicer by logging into your account at studentaid.gov.

Deferment

Deferring your student loans is only possible when you have specific circumstances that stop you from making payments. For example:

Automatic in-school deferment — this is the most common type, and some people are considering going back to school to avoid repayment and default. If you’ve been wanting to go back to school in the first place, more power to you! If you’re going just to avoid repayment, consider how much interest would accrue on your loans and how much additional tuition fees would be added to your current balance.

Cancer treatment deferment for people undergoing cancer treatment, and for the six-month period after your treatment ends.

Economic hardship deferment for people receiving welfare benefits, serving in the Peace Corps, or working full-time but still have low income for their family size. Deferment can last up to 3 years.

Graduate fellowship deferment for people enrolled in an approved graduate fellowship program.

Military service and post-active duty student deferment for people on active military duty

Parent PLUS Borrower Deferment for parents who received a Direct PLUS loan to support their child’s education and that child is enrolled in school at least half-time.

Rehabilitation training deferment for people who are enrolled in an approved rehabilitation training program designed to provide vocational, drug abuse, mental health, or alcohol abuse treatment.

Unemployment deferment for people who receive unemployment benefits. This deferment is available for up to three years.

Complete your deferment application at studentaid.gov.

Nika at @debtfreegonnabe on Instagram made this awesome graphic to help people choose between deferment and forbearance:

How do I get my loans out of default?

Here are your options4:

Repay your loan in full. Obviously, if you could afford to do that, you probably wouldn’t be in this situation. This isn’t an option that’s available to everyone.

Loan rehabilitation. You agree in writing to make nine voluntary, reasonable, and affordable monthly payments within 20 days of the due date for 10 consecutive months. Once your loans are rehabilitated, you’ll qualify for income-driven repayment plans, deferment, forbearance, and loan forgiveness programs again. The record of default will be removed from your credit history.

Loan consolidation. You consolidate your defaulted student loans into a new Direct Consolidation loan. You’ll receive most of the same benefits as loan rehabilitation once you consolidate, but this option does come with more fees and accrued interest. For this option, the record of default will not be removed from your credit history.

The big picture: Republicans’ proposed changes to student loans could limit students’ access to higher education

According to NPR, the Trump administration wants to change the student loan system in the following ways:

Eliminate previous income-driven repayment plan options and replace them with one “Repayment Assistance Plan”

End Graduate PLUS loans, which would limit access to graduate degrees

Set a borrowing limit of $50,000 on Parent PLUS loans

Force colleges and universities to reimburse the federal government for a share of the debt when students fail to repay their loans

Borrowing limit of $50,000 for undergraduate students, $100,000 for graduate students, and $150,000 for professional programs

These changes to the student loan system are part of a bigger plan outlined in Project 2025. I anticipate that people will be less motivated to receive a college education due to the cost, even though colleges are sites of political awakening and network-building for so many young people.

More than ever, it’s time to embrace free or affordable popular education, a methodology where teachers and students don’t exist in two separate hierarchical groups, where people with marginalized identities can take control of their own learning and center their own experiences.

I’ve been inspired by teachers like Karen Attiah, who decided to continue teaching her course on Race and Media online even though Columbia University canceled it. I’ve also been inspired by orgs like Economics for Emancipation, which posted their self-guided curriculum online for free. Any group can access and study this rich material and apply it to their daily lives.

We need more of these models if we are going to resist the incoming changes to student loans and the Department of Education as a whole.

Drop your questions in the comments <3

Question - last time I heard they are not currently processing any applications for income driven repayment plans because of the SAVE lawsuit. Do you know if this has changed? I’ve been waiting for almost a year to get my application process

Hi! I applied for the SAVE program which yeah looks like it won’t be happening buuuuut my loans have been in administrative forbearance while the courts figure it out. I have seen on Reddit some folks saying they’re gonna just wait and see what happens, right now I’m looking at next payment due in August under the same amount my previous IDR is at. Any thoughts on whether I should just let the courts take officially dead the SAVE plan to have a few more months? Was thinking about reapply for a different IDR but was anxious it would somehow take me out of this forbearance grace period