Updates on SNAP + student loans

We take care of each other when governments fail us 💪

Things are bleak right now.

Layoffs are at their highest rates in the US, according to CBS. People are losing their jobs left and right, with little to no savings to their name. 40 million Americans are about to lose SNAP benefits due to the government shutdown, according to NBC News.

But there are slivers of hope:

Thanks to the American Teachers Federation (ATF), borrowers can receive student loan forgiveness through income-driven repayment plans again, CNBC reports. Communities are showing up for each other. Farmers’ markets and restaurants are slashing their prices to take care of customers. People are filling up local food banks and buying groceries for their chosen family members.

In times like these, there’s comfort in the smallest, simplest solutions — the little actions that give you enough of a confidence boost to participate in the bigger things, like community organizing, joining a patrol to protect your neighbors against ICE, and attending a protest.

In the spirit of clarifying the dizzying headlines about money right now, here are a few updates (and helpful tips) about SNAP and student loans.

🤝 I’m still accepting 1:1 clients. To request a 20-minute consultation, fill out this form.

👨🏫 Hire me to teach! In the past, I’ve taught at institutions like Northwestern University, UC Berkeley, and CSULA. If you’re interested in hiring me to speak or teach, please fill out the form on this page.

SNAP benefits are on hold until the government shutdown ends

Some tips for those who are affected:

Go to findhelp.org to find a food bank and other assistance programs near you.

Find a Free Little Pantry near you. Pantry locations are usually spread by word of mouth or local flyers.

DoorDash is partnering with 300+ food banks and waiving delivery fees for about 300,000 orders between November 1 and 30, 2025. Use the promo code SNAPDD to redeem. This offer is only available to customers with valid SNAP/EBT card numbers.

For those who have stable income and want to give back to their communities:

Drop off groceries at a food bank.

Start or stock a Free Little Pantry in your neighborhood. The site has instructions that help you build your own and guidelines for spreading the word. Do not underestimate the importance of this local resource! In my building, a neighbor has been stocking a free box of fresh bread in the lobby. Another neighbor left a note recently that said, “Thank you for doing this. Times have been hard and this has really made a big difference.”

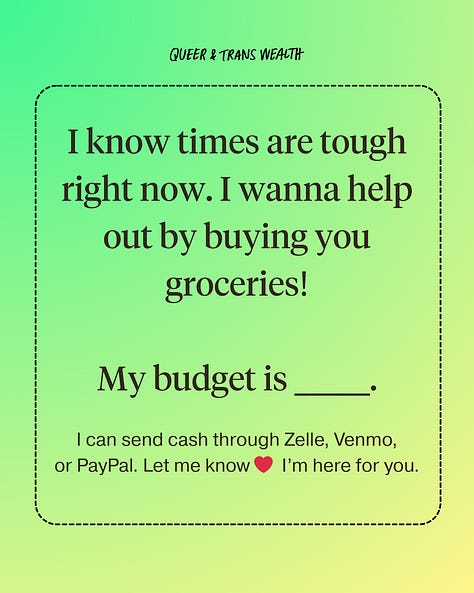

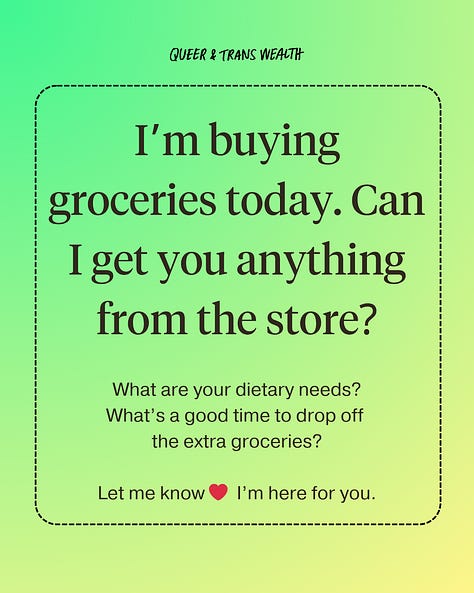

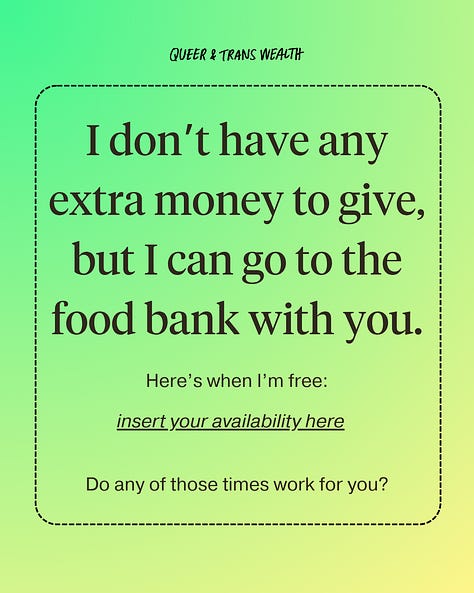

I created these digital cards on Instagram so you can let your loved ones know that you’re down to help. There’s a huge stigma against receiving SNAP/EBT to begin with. It can be hard for people in this position to ask for help. Make things easier for people who need support by starting the conversation. Let folks know exactly how much you have to give. This relieves so much anxiety from folks who feel like they’re “asking too much.”

Student loan platforms say that SAVE Plan borrowers will be in forbearance until 2028

Recently, my friends and clients have been telling me that they’ve received emails from their student loan servicers. Some say, “There’s been an update on your student loans.” Others’ accounts — including mine — say that they won’t have any payments due until 2028.

I hate to say this, but… we can’t fully get our hopes up.

Technically, under the One Big Beautiful Bill signed into law in July, the SAVE Plan will be repealed altogether on July 1, 2028. According to Forbes, the longest that the administrative forbearance could last for those on the SAVE Plan is July 2028.

This doesn’t guarantee that the SAVE Plan administrative forbearance will last until July 2028, though. Legislation can change at any point, and borrowers might be required to make payments again on short notice.

Student loan policy updates ⚖️

Here’s a quick recap of recent student loan policy updates:

Under the Biden Administration’s SAVE Plan, borrowers on an income-contingent repayment (ICR) and Pay as You Earn (PAYE) plans would have received student loan forgiveness after 20 to 25 years of payments on student loans.

Since the SAVE Plan has been held up in court, the Trump Administration has stopped processing forgiveness for borrowers who have been making payments for 20 to 25 years.

The Trump Administration has also stopped processing student loan forgiveness for nonprofit and government workers through the Public Service Loan Forgiveness (PSLF) program.

Borrowers have been navigating a hellscape called the PSLF Buyback Program, a program that allows you to buy back months in your payment history to convert them into qualifying payments through PSLF, which can help get your loans forgiven faster. The Trump Administration has been dragging its feet in processing PSLF Buyback applications.

Last week, the American Federation of Teachers (ATF), a teachers’ union with 1.8 million members, won a legal battle with the Trump Administration that reinstated forgiveness for borrowers on ICR and PAYE plans after 20 to 25 years of payments.

ATF also pressured the Administration to begin processing PSLF Buyback applications as soon as possible.

Special mention: Trump signed an executive order on March 7 to exclude organizations that support trans people from PSLF. There haven’t been other legislative actions to move this effort forward, but I’m keeping my eyes peeled for updates.

Student loan tips 💡

Log onto studentaid.gov to check the status of your student loans. The ATF only won this lawsuit last week, so if you’re eligible for student loan forgiveness, it might take some time for your loan account to reflect that change.

Screenshot and download any student loan correspondence. This is so important, y’all! I do not trust this Administration to keep correct records of past payments and balances. Having your own copy of your student loan records can help you prove that you’ve made qualifying payments.

Find your estimated monthly student loan payment and put that payment amount in your savings each month. Practice putting that payment in your savings. For example, if you have a $250 monthly payment on student loans, between now and July 2028, you’ll save a total of $8,000 over 32 months.

If you’ve read all the way to the end of this newsletter, thank you for being here! Let me know in the comments or DMs if this post was helpful. 🫂

is it better to put the money away each month or to just make the payments monthly even though they're not due?

Thank you!!!!! Your info on student loans is so helpful- I am truly so overwhelmed by it all and I appreciate your breakdowns so much!!!!!